Biotech, to time with a Good Feeling

The following does not apply to you, of course, but most investors tend to enter when a stock or market is already very much up or perhaps at its peak. Simply because greed and ‘fear of missing out’ often overrides rational decision-making.

Conversely, many investors exit when they become frustrated with a stock or the market’s continuous decline. Instead of delving into the underlying reasons, they act out of fear of losing more money.

Ebb and flow

Similar to many aspects of life, the stock market experiences wave-like motions. It would be nice to know when stocks are at their lowest price (entry point) or at their highest point (exit point). Of course, that exit moment is just a snapshot because for solid companies, their share prices keep appreciating over a long period of time. Think Coca-Cola or biopharma companies like Novartis or Vertex.

A prime example of a wave-like movement is evident in the S&P Biotech index, which plummeted around 50% from its peak in mid-February 2021. How did that happen?

Covid-19

The COVID-19 pandemic caused temporary halts and delays in clinical trials. Hospitals were full and staff were (too) busy.

Consequently, the development of new medicines, excluding those for COVID-19 treatment, was hampered.

Another contributing factor to the drop was a flood of nearly 200 IPOs, with many companies claiming to develop cures or vaccines for COVID-19, often without sufficient clinical data. Investors who believed they had struck gold sold when it turned out their investment had little value. As a result, the prices of these companies collapsed, impacting the entire biotech sector.

Interest Rates

Additionally, interest rate hikes influenced by inflation negatively affected the stock prices of tech and biotech companies.

Bottom Reached?

Over the last six months however, the S&P Biotech moved horizontally and the bottom appears to have been reached. What usually happens after such a big drop?

Biotech in top-5 Growth Sectors

The majority of asset managers have the biotech sector (read: healthcare sector) among their top five favorite growth sectors for the future. The reasons they cite for this are:

- Global ageing population.

- Significant innovation in the sector.

- Increasing demand for ‘Western’ medicines in ’emerging markets’.

- Medicine companies’ ability to withstand inflationary pressures.

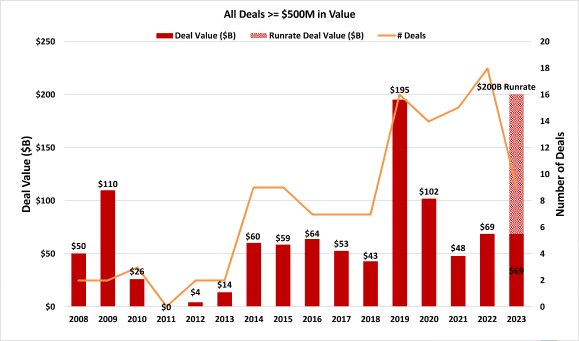

Jefferies predicts that M&A activity in the sector this year will match the record levels seen in 2019. (Source: Jefferies, May 2023). M&A in biotech results in high acquisition premiums, around 85% on average. Attractive for investors!

Additionally, Reuters forecasts an increase in IPOs after the summer for biotech companies with proven value backed by positive data from clinical trials. (Source: Reuters, June 2023).

Currently, many medicine companies are undervalued in the stock market. In particular, those companies that are well-funded and have a broad pipeline of breakthrough medicines have an exciting investment potential. Especially if they are companies developing medicines for conditions for which no (good) treatment exists yet. Thanks to new technologies such as gene, RNA and cell therapy, we can now treat many more diseases than before.

88 such Genetics medicines are already on the market. 2.000 are in development of which 200 are in the final clinical phase. The Genetics companies developing these therapies have a great opportunity to generate significant returns for investors. Especially as their innovative medicines move towards approval and sales.

Where lies the Danger?

One biotech company is not like another and with some 1.000 listed biotech companies in the EU and US combined, it is not only difficult to choose. Making the wrong choice could result in a substantial loss of investment. Of the listed biotechs, hundreds are still in a very risky phase. At least, they are too risky for the Aescap funds to invest in. Our funds, for instance, avoid investing in companies that:

- Don’t have medicines on the market.

- Lack proven efficacy in clinical trials.

- Lack adequate funding.

- Have management that does not act in the interests of shareholders.

A small proportion of the companies in our funds may have some risk of temporarily going through a downturn, but we certainly don’t want to risk losing money

What is Certain?

It is almost certain that a currently undervalued biotech company bringing medicines to market that are better than what is currently available will experience a significant share price performance.

Although market conditions can affect investor sentiment, there are many biotech companies with great upside potential.

Investing in biotech definitely requires thorough research into the company and specialized knowledge of the sector. However, promising undervalued biotech companies offer an excellent opportunity for substantial future returns.

Waiting until the sector is back in the spotlight often results in missed opportunities. As prices would have already risen by then.

When will you step in with a Good Feeling?

The Aescap Life Sciences Fund and the Aescap Genetics Fund invest in companies developing innovative medicines. In doing so, we offer investors the opportunity to invest in the future winners of the healthcare industry.